Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Markets

Filters

Show only:

Loading…

Gurugram, February 24, 2026 (IST) – One MobiKwik Systems Limited (NSE: MOBIKWIK | BSE: 544305) has received approval from BSE Limited to commence stock broking operations through its wholly owned subsidiary, Mobikwik Securities Broking Private Limited (MSBPL), marking its formal entry into the equity broking segment.The company informed exchanges that MSBPL has been approved for commencement of business as a Trading Member on BSE Limited, with the intimation received on February 23, 2026 at 17:34 PM IST.BSE Platform Activation from February 24

According to the company’s press release, BSE has enabled MSBPL on its platform with effect from February 24, 2026, allowing the subsidiary to initiate full-fledged stock broking operations...

Indian equity markets are poised for a cautious opening on February 17, tracking mixed global cues and softer trends in early Asian trade. Despite a strong rebound in the previous session, early indicators suggest a negative start for the benchmarks.GIFT Nifty Signals Weak Opening

The GIFT Nifty was trading lower at around 25,641 in early trade, indicating a subdued start for the domestic markets.On February 16, Indian benchmark indices snapped a two day losing streak and ended higher in a volatile session. The rebound was driven by strong buying in power, energy, realty, and financial stocks.At close:The Sensex gained 650.39 points or 0.79 percent to settle at 83,277.15

The Nifty advanced 211.65 points or 0.83 percent to close...

Silver prices witnessed a sharp pullback on February 17, raising fresh questions about whether the metal can scale new record highs in 2026 despite strong gains last year.

Silver Falls to $73, Recovers Slightly

In the early hours of February 17, silver prices dropped to as low as $73 per ounce. The metal later recovered some ground to trade at $75.50 per ounce at 01:44 am GMT, still down 2.88 percent from the previous close.

On the domestic front, silver futures on MCX closed Monday’s session at Rs 2,40,201 per kilogram, marking a 0.13 percent decline from the previous close. Earlier in the first week of February, prices had slipped toward the Rs 2.30 lakh level amid global selling pressure and heightened volatility.

Meanwhile, the...

Gold Slips 1.36% to $4,977 per Ounce; Analysts See Volatile, Range-Bound Trend

Gold prices declined 1.36 per cent to $4,977 per ounce on Monday, as subdued global trading conditions kept price action largely contained. Much of Asia remained closed for the Lunar New Year, while US markets were shut for a holiday.Despite the dip, bullion continued to hover near the $5,000 mark, indicating sustained investor participation after a period of heightened volatility.Gold Stabilizes Near $5,000 After Sharp Swings

Spot gold was little changed at $4,990.08 an ounce as of 7:45 a.m. in Singapore, following a 1 per cent fall in the previous session.The metal had surged to a record above $5,595 per ounce in late January amid a wave of...

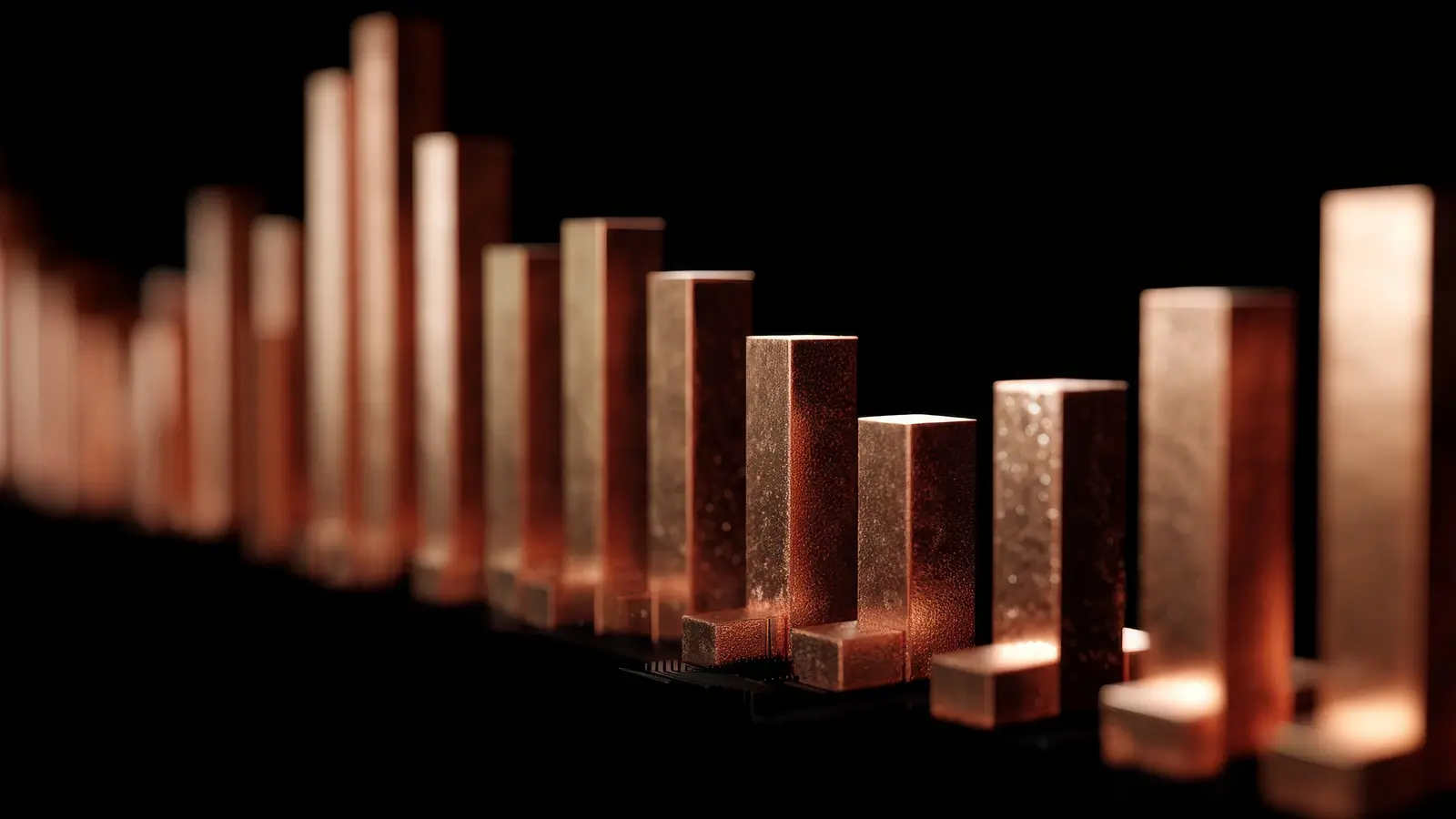

BHP Group reported a stronger than expected half-year performance, with underlying profit rising 22 percent as copper earnings overtook iron ore for the first time in the company’s history. The result reflects surging demand for copper, driven by artificial intelligence infrastructure and the global shift toward cleaner energy.The world’s largest miner saw its shares climb 7 percent to a record high after announcing robust earnings and a dividend that exceeded market expectations.Half-Year Profit Rises 22 Percent to $6.20 Billion

For the six months ended December 31, BHP posted an underlying attributable profit of $6.20 billion, beating the Visible Alpha consensus estimate of $6.03 billion.The company declared an interim dividend...

Indian IT stocks remain under pressure as artificial intelligence driven disruption reshapes investor expectations. With valuations correcting sharply and long term growth assumptions being recalibrated, global brokerage firms UBS and Nomura have presented distinct perspectives on whether the current downturn signals structural risk or a cyclical reset.AI Anxiety Drives Volatility in IT Stocks

Shares of Indian IT services companies continue to witness volatility amid rising concerns that AI could disrupt traditional outsourcing and application development models. The debate now centers on whether AI poses an existential threat or opens up a new growth cycle.Brokerage analysts at UBS and Nomura have assessed the sharp correction...

Indian equity markets head into the February 16 trading session with a heavy mix of earnings reactions, regulatory updates, acquisitions, and fresh listings. From quarterly scorecards to major approvals and strategic deals, several frontline and midcap names are set to remain in focus.Here is a structured look at the key stocks to watch today.Mainboard Listings in Focus

Fractal Analytics and Aye Finance

Shares of Fractal Analytics and Aye Finance are scheduled for listing on the mainboard. Both IPOs will be closely tracked as investors assess listing performance and subscription response in the secondary market.Key Quarterly Earnings to Track

Ola Electric Mobility

Ola Electric Mobility reported a narrowing of losses in Q3 on a...

Mumbai, February 16: Mutual funds have turned net sellers in Indian equities for the first time in nearly three years, offloading shares worth approximately Rs 4,100 crore so far in February, marking a sharp shift after a prolonged buying streak.This is the first instance of net selling since April 2023, when mutual funds sold over Rs 4,532 crore in domestic equities. Between May 2023 and January 2026, domestic institutional investors had remained net buyers for 34 consecutive months, underlining the significance of the current reversal.February Selling Follows Heavy January Buying

The latest selling comes on the back of sustained accumulation in recent periods. Mutual funds had purchased equities worth Rs 42,355 crore in January...

RBI Clears Proposed Investment by Bain Capital Affiliates

Shares of Manappuram Finance are expected to remain in focus on Monday after the company received conditional approval from the Reserve Bank of India for a proposed stake sale to affiliates of Bain Capital.In a regulatory filing, the company confirmed that the central bank has approved the proposed investment by BC Asia Investments XXV Limited and BC Asia Investments XIV Limited, both affiliates of Bain Capital.The approval paves the way for the proposed acquisition of control and shareholding of up to 41.66 percent of the paid up equity capital or convertible instruments of Manappuram Finance.Conditions Attached to RBI Approval

The regulatory clearance comes with specific...

Indian equity markets ended sharply lower on Friday, with broad-based selling across sectors dragging benchmark indices down. Consumer, IT, and energy stocks emerged as the biggest laggards, reflecting heightened caution among investors ahead of the new trading week.The Nifty 50 closed at 25,471.10, down 336 points or 1.30 percent, while the BSE Sensex tumbled 1,048.16 points, or 1.25 percent, to settle at 82,626.76. The volatility gauge, India VIX, ended at 11.73, lower by 1.53 percent from the previous close, although it had surged earlier during the session.Here are the 10 key factors likely to influence stock market action on Monday.1. Nifty’s Technical Breakdown Below Key Moving Averages

According to Nilesh Jain, Vice...

Indian Gold Demand Remains Strong Despite Price Volatility

New Delhi, February 15: Volatility in gold prices has not discouraged Indian consumers. Instead, buyers are increasingly treating price corrections as entry opportunities, mirroring strategies commonly seen in the equity markets, according to Ajoy Chawla, Managing Director of Titan Company.Chawla said that many customers who once delayed purchases amid rising prices are now adopting a more tactical approach. Rather than waiting indefinitely for a steep fall, they are stepping in during price dips."People have learned from their experience of waiting, so they are now using every correction to enter the market, just as they do in the stock market," Chawla said.Volatility...

The broader market delivered a mixed performance this week, but smallcap stocks emerged as clear outperformers, with nearly 100 counters rallying up to 46 percent. Despite pressure on benchmark indices, the smallcap space showed resilience amid stock specific buying.Sensex and Nifty Close Lower Amid IT Selloff

In a volatile trading week, the BSE Sensex declined 953.64 points, or 1.14 percent, to close at 82,626.76. The Nifty50 fell 222.6 points, or 0.86 percent, to end at 25,471.10.Heavy selling in technology stocks weighed on the benchmarks. The Nifty IT index dropped more than 8 percent during the week. The Nifty Energy and Oil and Gas indices fell around 2 percent each, while the Nifty FMCG index slipped nearly 2 percent.On the...

New Delhi, February 15India’s stock market is set for a cautious week ahead as macroeconomic data, global geopolitical developments, and rising concerns over artificial intelligence related disruptions are expected to shape investor sentiment. Ongoing volatility is likely to keep participants watchful, with foreign investor activity and currency movements also playing a crucial role.Global Cues and Fed Policy in Focus

With tariff concerns easing and the domestic earnings season drawing to a close on a mixed trend, markets are expected to take direction from global signals. These include US labour market data and shifting expectations around the US Federal Reserve’s policy path.Vinod Nair, Head of Research, Geojit Investments Ltd...

FPIs Invest ₹19,675 Crore in Early February

New Delhi, February 15: Foreign Portfolio Investors have staged a significant turnaround in February, injecting ₹19,675 crore into Indian equities during the first fortnight of the month. The revival in inflows has been supported by the US India trade deal and easing global macroeconomic concerns.The renewed buying momentum comes after three consecutive months of sustained selling by foreign investors.Three Months of Persistent Outflows

According to data from depositories, FPIs withdrew ₹35,962 crore in January, ₹22,611 crore in December, and ₹3,765 crore in November.Overall, in 2024, FPIs pulled out a net ₹1.66 lakh crore, equivalent to USD 18.9 billion, from Indian equities. The...

Palwal, February 9, 2026: DEE Development Engineers Limited (BSE: 544198, NSE: DEEDEV) reported a steady expansion in its order book during January 2026, supported by fresh order inflows across its core piping and heavy fabrication businesses. The company’s consolidated order book stood at ₹1,319.91 crore as on January 31, 2026, compared with ₹1,302.73 crore at the beginning of the month.

January Order Book Movement (₹ crore)Particulars

AmountOpening order book as on January 1, 2026

1,302.73Order inflow during January 2026

92.77Orders executed during January 2026

75.59Closing order book as on January 31, 2026

1,319.91The company also indicated that it is the lowest bidder (L1)...

Stronger Growth Seen in First Half of FY27

The Reserve Bank of India has revised its real GDP growth forecast upward for the first half of the 2026–27 financial year, citing support from trade agreements, GST rationalisation, and robust agricultural output.The central bank now expects the Indian economy to grow 6.9 per cent in the April–June quarter of FY27, followed by 7 per cent growth in the July–September period. These projections mark an improvement over estimates released in December, when growth for the June quarter was pegged at 6.7 per cent and the subsequent quarter at 6.8 per cent.Full-Year FY27 Projections to Follow in April

The RBI said that projections for the full financial year 2026–27 will be announced in the April...

Rupee Trades in a Narrow Range on Thursday Morning

The Indian rupee traded within a tight band and strengthened by 7 paise to 90.40 against the US dollar in early trade on Thursday, as corporate dollar demand persisted and investors remained cautious while awaiting confirmation on the India US trade agreement.Market participants shifted their focus from initial optimism to verification, as no official documents have been released so far and neither side has formally published the final terms of the proposed trade deal.RBI Policy Decision in Focus

Apart from trade-related clarity, investor attention is also firmly on the upcoming interest rate decision by the Reserve Bank of India, scheduled for Friday. The policy outcome is expected...

Strong Opening in Early Trade

The Indian rupee strengthened sharply in early trade on Tuesday, appreciating 119 paise to 90.30 against the US dollar. The move followed a significant reduction in US tariffs on Indian goods to 18 percent from the earlier 50 percent level.At the interbank foreign exchange market, the rupee opened at 90.30, marking a sharp gain from its previous close of 91.49.Impact of US India Trade Developments

The tariff reduction was announced after the conclusion of a US India trade agreement, endorsed by US President Donald Trump and Indian Prime Minister Narendra Modi. The lower tariff level improves India’s relative trade position compared with some regional peers and has had an immediate impact on currency...

Benchmark Indices Surge in Early Trade

Indian equity benchmarks opened Tuesday on a strong note, with the BSE Sensex and Nifty 50 posting sharp gains after India and the United States agreed on a trade deal that lowers reciprocal tariffs on Indian goods.In early trade, the 30 share Sensex surged 3,656.74 points to 85,323.20, while the 50 share Nifty climbed 1,219.65 points to 26,308.05.Rally Extends as Buying Momentum Strengthens

The bullish momentum continued through the session. The Sensex advanced 4,205.27 points, or 5.14 percent, to 85,871.73. The Nifty jumped 1,252.80 points, or 4.99 percent, to 26,341.20, reflecting broad based buying across sectors.Trade Deal Boosts Market Sentiment

The rally followed confirmation that...