Mumbai, January 19, 2026: Shares of Bharat Coking Coal Limited made a strong stock market debut on Monday, listing at levels close to ₹45 per share, translating into a gain of about 95–97 percent over the IPO issue price of ₹23.

The stock entered the market through the special pre-open session, where price discovery reflected heavy buying interest, in line with the extremely strong demand seen during the IPO subscription period.

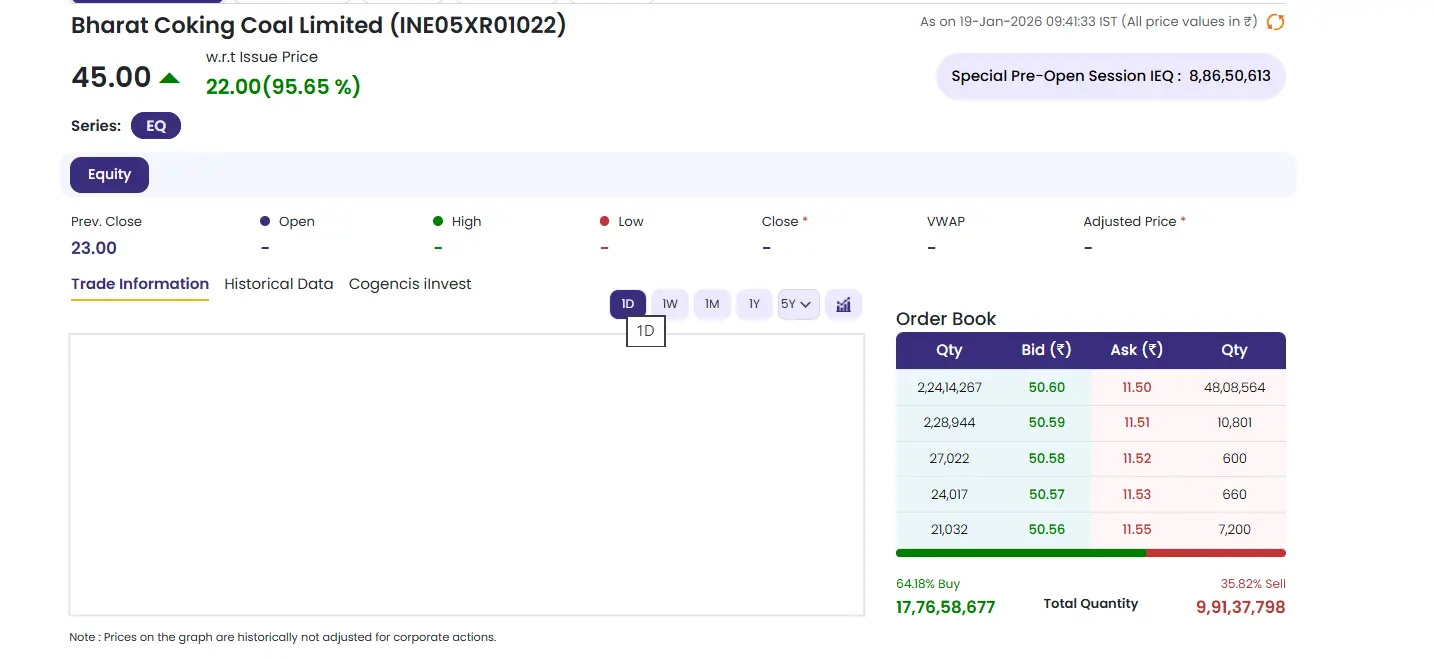

Listing Snapshot (as of around 9:39 AM IST)

- Listing / Reference Price: ~₹45.00–₹45.21

- IPO Issue Price: ₹23.00

- Premium on Listing: ~₹22 per share

- Listing Gain: ~95–97%

- Series: EQ

- 52-week High / Low (on debut): ₹45.21

Order Book Shows Strong Buying Interest

Early order book data indicated sustained demand at higher price levels:- Buy-side interest: Over 64 percent

- Sell-side interest: Around 36 percent

- Bid prices clustered near the upper circuit zone, reflecting aggressive demand post-listing

IPO and Subscription Recap

The Bharat Coking Coal IPO was among the most oversubscribed public issues in recent years, closing with an overall subscription of around 143.85 times. Demand was exceptionally strong across all investor categories:- Qualified Institutional Buyers (QIBs) drove a massive final-day surge

- Non-Institutional Investors (NIIs) recorded extremely high subscription multiples

- Retail Individual Investors (RIIs) and the shareholder reservation portion also saw deep oversubscription

LIC Anchor Investment

Ahead of the IPO opening, Life Insurance Corporation of India emerged as the single largest anchor investor in the issue. LIC invested ₹78.00 crore, acquiring 3,39,13,200 equity shares at the upper end of the price band of ₹23 per share.The anchor allocation, finalised on January 8, 2026, accounted for 28.56 percent of the total anchor portion, providing strong institutional backing ahead of the public issue.

GMP vs Actual Listing

In the days leading up to listing, the grey market premium (GMP) for the IPO ranged between ₹12 and ₹14 per share, indicating an estimated listing price of ₹35–₹37. The actual market debut near ₹45 exceeded these informal grey market indications, translating into a listing premium of nearly 96 percent, well above GMP-based expectations.About Bharat Coking Coal Limited

Bharat Coking Coal Limited is a Government of India enterprise and a subsidiary of Coal India Limited. The company is engaged in the mining and supply of coking coal and non-coking coal, with operations primarily located in the Jharia coalfields of Jharkhand and the Raniganj coalfields of West Bengal. It plays a critical role in supplying raw material to India’s steel and core industrial sectors.The strong debut marks a significant milestone for Bharat Coking Coal’s entry into the public markets, capping a closely watched IPO journey.

Reference:

Disclaimer: Due care and diligence have been taken in compiling and presenting news and market-related content. However, errors or omissions may arise despite such efforts.

The information provided is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Readers are advised to rely on their own assessment and judgment and consult appropriate financial advisers, if required, before taking any investment-related decisions.

Last edited: