As investors await the allotment outcome for the IPO of E TO E Transportation Infrastructure Limited, attention has turned to the likelihood of securing shares amid record demand.

The IPO closed with an overall subscription of 489.52 times, making it one of the most heavily subscribed issues in recent times. Such a high level of oversubscription indicates intense competition across all investor categories, particularly in the retail and non-institutional segments where applications far exceeded shares on offer.

In heavily oversubscribed IPOs, allotment is typically carried out through a lottery-based system in eligible categories, subject to regulatory guidelines. This means that even valid applications may not receive allotment due to the sheer volume of bids.

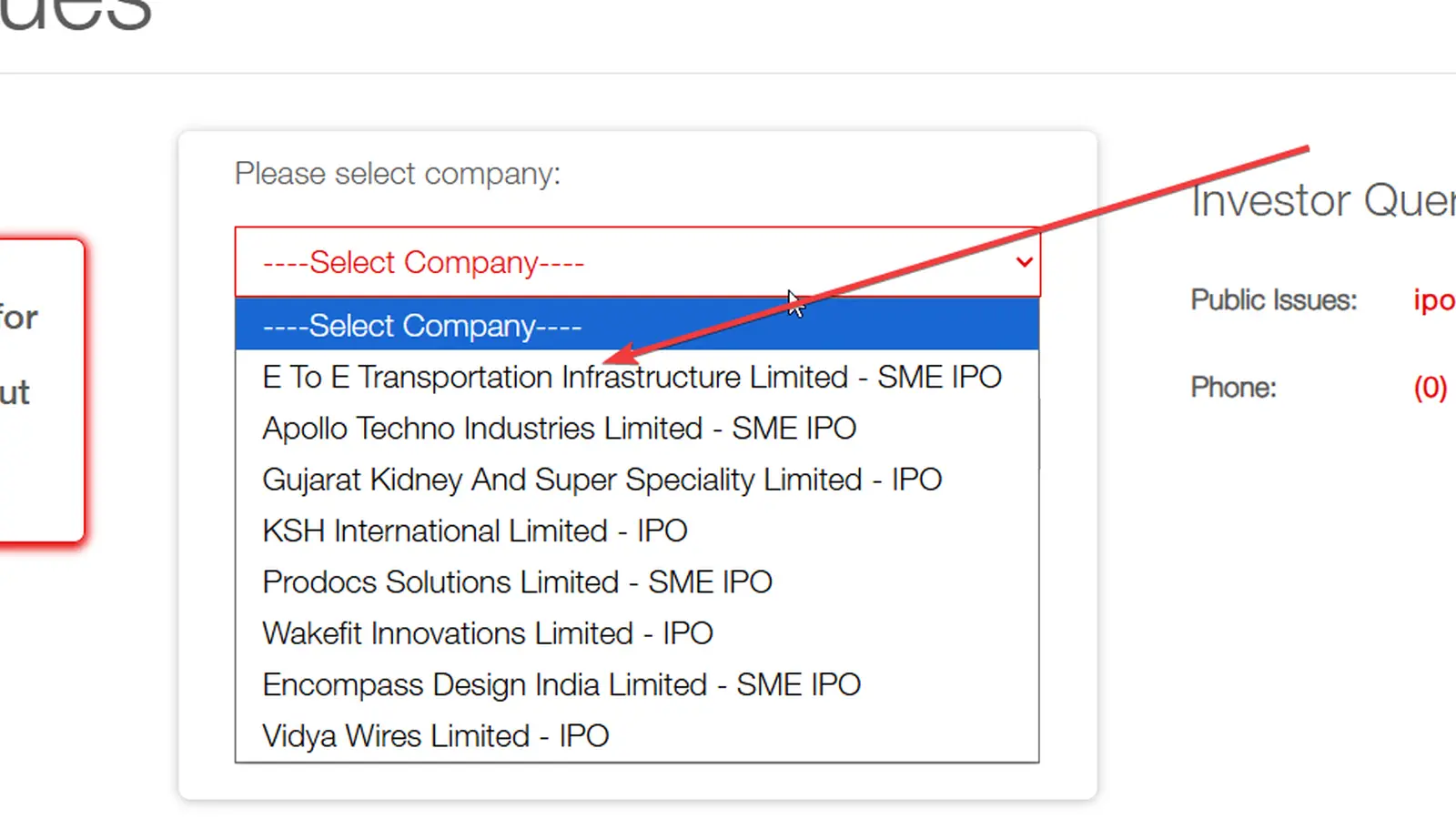

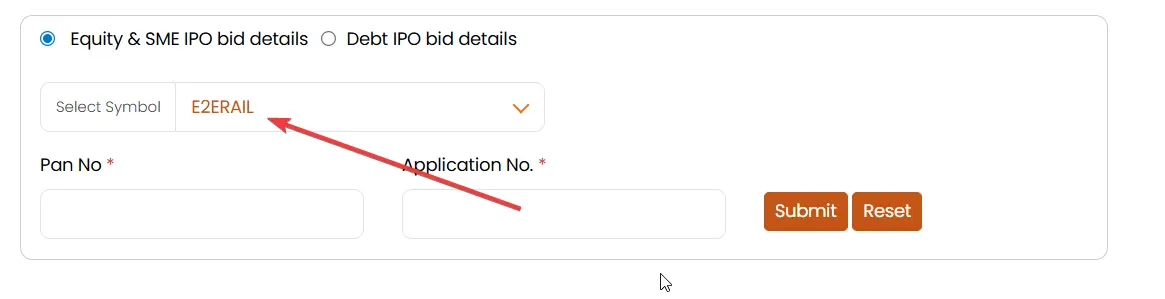

Investors are advised to track the official allotment announcement from the registrar, as that will provide the final clarity on allotment status.

The IPO closed with an overall subscription of 489.52 times, making it one of the most heavily subscribed issues in recent times. Such a high level of oversubscription indicates intense competition across all investor categories, particularly in the retail and non-institutional segments where applications far exceeded shares on offer.

In heavily oversubscribed IPOs, allotment is typically carried out through a lottery-based system in eligible categories, subject to regulatory guidelines. This means that even valid applications may not receive allotment due to the sheer volume of bids.

Investors are advised to track the official allotment announcement from the registrar, as that will provide the final clarity on allotment status.